Principal 401k withdrawal calculator

Not an easy task. You divide the December 31 balance of each account by your life expectancy as estimated by IRS life expectancy tables.

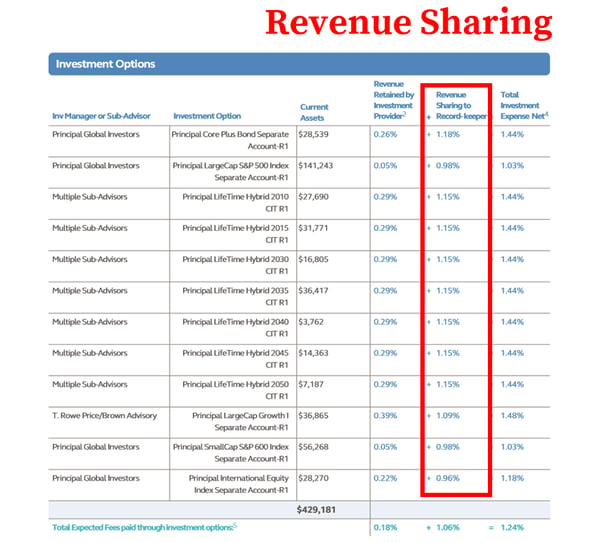

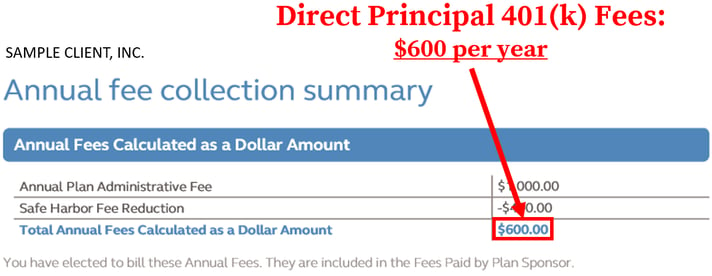

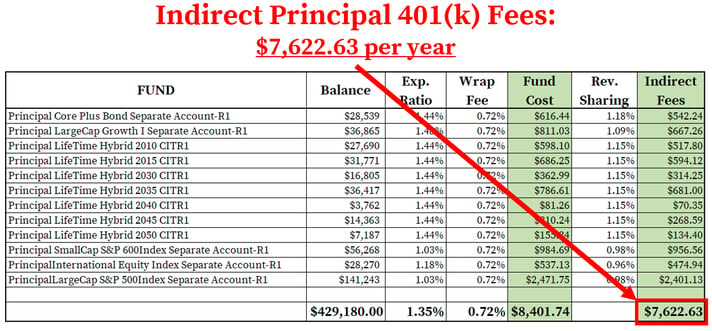

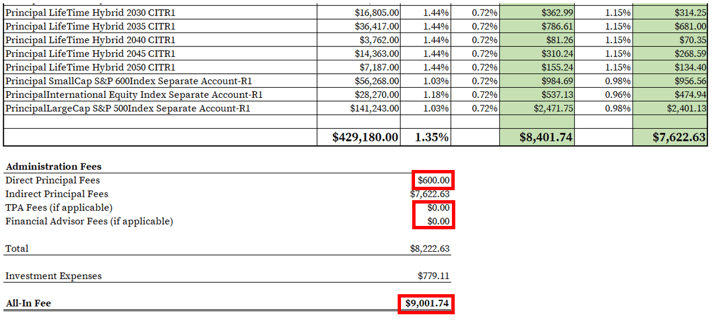

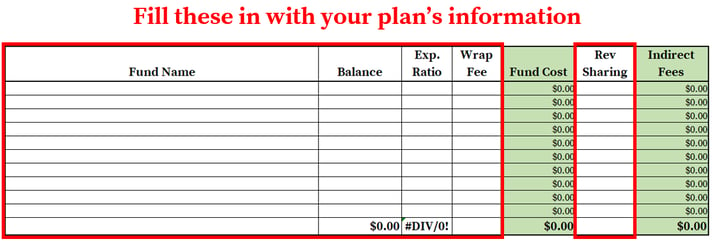

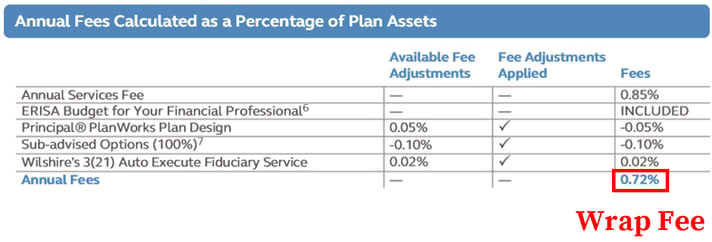

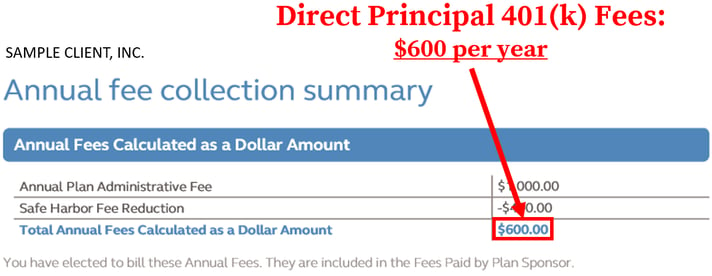

How To Find Calculate Principal 401 K Fees

This includes 401k IRA TSP brokerage accounts savings bonds and investment property.

. Ad Use Our Early Withdrawal Calculator Tool To Understand The Potential Impacts. Dedicate part of each paycheck to big goals such as retirement or education in accounts that earn differently than regular savings. Add up all of your income-producing assets that you plan to live off of.

Using this 401k early withdrawal calculator is easy. Box 219971Kansas City MO 64121-9971For overnight deliveryPrincipal Funds430. Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans.

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate and your expected annual rate of return. Whatever Your Investing Goals Are We Have the Tools to Get You Started. 5Interest Rate compounded Annually 35Inflation Rate.

Quickly see whether youre on track with your retirement goals and see which small changes could add up to a potentially big impact. If there is 2 percent of inflation which is the target rate of inflation in the US and most countries you will withdraw 12240 dollars in the following year. This is a very tricky calculation since you dont know what youll earn in any given year nor what the rate of inflation will be nor how long youll live.

The IRS provides worksheets to help with the calculation. 2 1 IRS annual limits for 2022. 25Years until you retire age 40 to age 65 35Years of retirement.

As you get older and your life expectancy decreases your RMDs will increase. 270294750 or 27029475amount saved at time of retirement. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset growth tax consequences and penalties based on information you specify.

Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. And the leftover sum you receive if you happen to be in a higher tax bracket may nudge you into paying even more taxes for that additional annual income. 869417 Your desired annual retirement income 120000 Your annual income from this plan 194714 You are on track to meet your goal and will have 74714 more than your desired amount of income each year from this plan.

At age 90 for instance youll need to withdraw almost 10 of your accounts value. Use the forms below to request a distribution or redemption from your Principal Traditional IRA Roth IRA SIMPLE IRA SEP IRA or 403b7 accountSubmit completed forms to your financial professional or directly to Principal FundsMail completed forms toPrincipal FundsPO. Calculate your income protection needs You can get a quote in minutes.

To give you an idea 20000 in a 401 k 403 b or 457 b account could triple in 20 years at an average 7 rate of returnbut not if you withdraw it today. The advantage of the 4 percent rule is that its a simple approach and your buying power keeps up with inflation. You decide to increase your annual withdrawal by 35 and want the money to last for 35 years with nothing left for heirs after that time.

Will you meet your income goal. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. To calculate your investment withdrawal amount for this year well need to answer a few questions.

With a click of a button you can easily spot the difference presented in two scenarios. Understand What is RMD and Why You Should Care About It. While it is most frequently used to calculate how long an investment will last assuming some periodic regular withdrawal amount it will also solve for the Starting Amount Annual Interest Rate or Regular Withdrawal Amount required if you want to dictate the duration of the payout.

The tools results represent analysis and estimates based on the information you have. You will find the savings withdrawal calculator to be very flexible. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you take a distribution before retirement from your qualified employer sponsored retirement plan QRP such as a 401k 403b or governmental 457b.

The goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life. For instance with a 50000 withdrawal you may keep just 32500 65 and pay 17500 35 in taxes and penalties depending on your state and tax bracket. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus.

To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation. If you return the cash to your IRA within 3 years you will not owe the tax payment. 2 Information is for illustrative purposes only.

401K and other retirement plans. If you dont have data ready to go we offer. Learn More About Potential Lost Asset Growth Tax Consequences Penalties At TIAA.

Log in to see your personalized Retirement Wellness Score based on your current retirement savings with services by Principal. The retirement balance potential future value assumes a 7 annual rate of return on their savings. Invest when youre ready.

See 3 steps to start investing Try Principal SimpleInvest An automated and personalized way to save for retirement. First how much are your investments presently worth.

How To Find Calculate Principal 401 K Fees

Retirement Withdrawal Calculator

2sgijz13wg V1m

3 Ways To Pay Off Your Debt Principal

How To Roll Over Your 401 K To An Ira Smartasset Saving For Retirement How To Plan 401k Plan

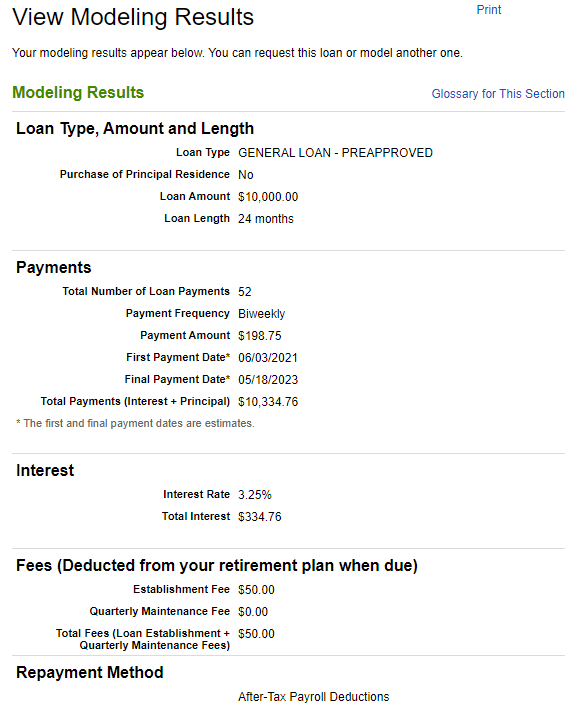

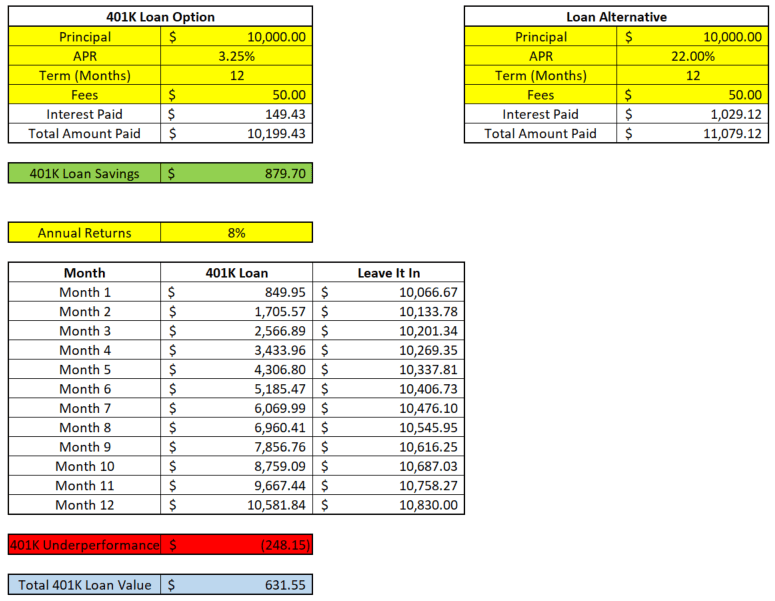

Use This Free 401k Loan Calculator To See If A 401k Loan Is Right For You

How To Find Calculate Principal 401 K Fees

Annuity Exclusion Ratio What It Is And How It Works

Bond Price Finance Apps Tax App Financial Calculator

Making A Choice For Your 401 K Principal

How To Find Calculate Principal 401 K Fees

Catch Up Contributions How Do They Work Principal

Use This Free 401k Loan Calculator To See If A 401k Loan Is Right For You

How To Find Calculate Principal 401 K Fees

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

Compound Interest Calculator For Excel

How To Find Calculate Principal 401 K Fees